Summerlin South Selling The Most Homes in 2024

February 19, 2024

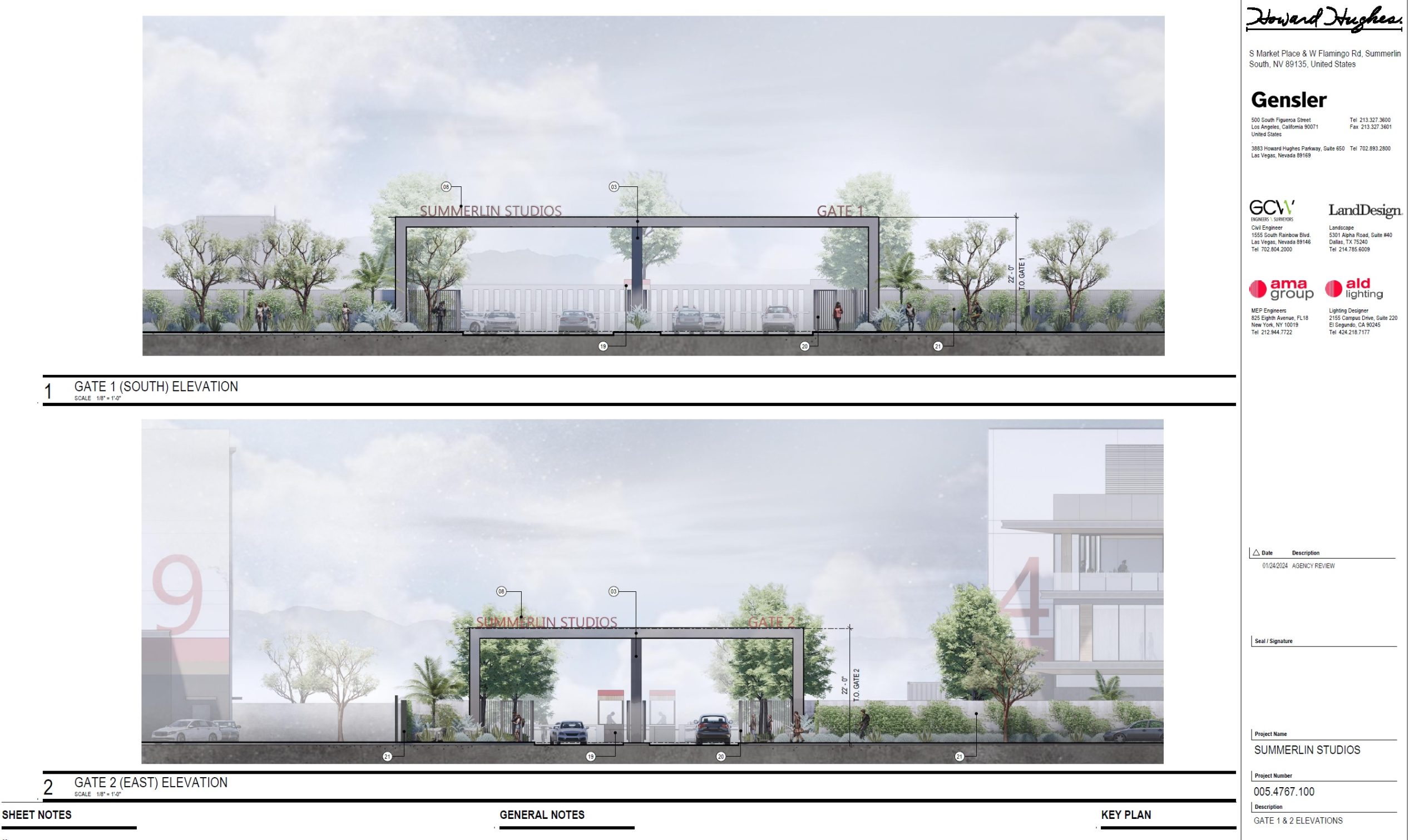

Summerlin Studios Project Takes Shape

March 1, 2024Had Enough of California’s Tax Rates? In this blog post I will explain how high California’s tax rates are and what that means to you. Is there a way around California’s tax rates? First off, as a former native of Los Angeles, CA. I understand what it’s like to live in California. California has the highest tax rates in the United States. If you are a high wage earner your tax rates when you factor in Federal and state taxes could be over 51.4%. Yes, that’s correct! This means that more than half of your wages are going towards a tax. What can you do to avoid all of these taxes? Read on and I will tell you how moving to Summerlin or Las Vegas can help you pay less to the government.

As your Summerlin Realtor and Summerlin real estate expert, I can explain to you Nevada’s no state income tax benefits. My blog post will address the California income tax rate, California Property taxes, and the California tax that is basically on anything at this point.

For many Californians, the burden of high taxes has become an overwhelming factor in deciding whether to stay or relocate. While moving to a state like Nevada, which has no state income tax, can certainly reduce your overall tax liability, strategic real estate tax planning is just as crucial. That’s where DMR Consulting Group comes in, offering expert accounting and financial guidance tailored specifically for real estate investors and businesses. Whether you’re purchasing property in Nevada to take advantage of tax benefits or managing real estate assets in California, understanding how tax laws impact your bottom line is essential.

From navigating property tax deductions and depreciation benefits to structuring your investments in a way that minimizes liabilities, the right financial strategy can make a substantial difference. Real estate is one of the most powerful wealth-building tools, but without proper tax planning, unexpected expenses can quickly eat into your profits. With expert insights from seasoned professionals, you can maximize returns, ensure compliance, and make informed decisions that align with your long-term financial goals.

Why Are Taxes So High In California?

First off, when you look at the amount of unfunded liabilities such as the pension system (CALPERS) as well as the loss of over 366,000 jobs in the state, things start to add up! California is currently sitting on a 1.6 TRILLION DOLLAR unfunded liability. This is a massive problem for the golden state. According to the Hoover Institution, this debt translates into $125,000.00 per person in California. Here is their article: Newsom’s $64 Billion Debt Proposal

First off, when you look at the amount of unfunded liabilities such as the pension system (CALPERS) as well as the loss of over 366,000 jobs in the state, things start to add up! California is currently sitting on a 1.6 TRILLION DOLLAR unfunded liability. This is a massive problem for the golden state. According to the Hoover Institution, this debt translates into $125,000.00 per person in California. Here is their article: Newsom’s $64 Billion Debt Proposal

Taxes are also high on property taxes as well as overall taxes on consumer goods too. All of these taxes are driving out people from the state which means the tax base will shrink too. When there are less people to pay taxes, those that remain will pick up the burden to pay that additional tax. Crime has also risen, the amount of retail theft has increased pricing for goods and services since retailers have to make up the costs of the amount of shrinkage they deal with yearly. Gas taxes are extremely high too and those taxes do nothing to improve California’s current road conditions. California politicians want to over tax you yet no one is saying no to this idea of taxation.

If taxes continues to go up because of government waste and spending, Califorina will have significant issues more than what they have already. In the next paragraph, I will address how you can over come all of this. The California income tax rate can be as high as 14.4% for some California residents. Most California residents are paying 13% for the California income tax rate. If you are concerned about the California income tax rate, maybe now is a good time to figure out a solution to this issue.

Is Moving Out of California a Good Idea?

As a Summerlin Realtor and Las Vegas Realtor I am going to tell you OF COURSE IT’S A GREAT IDEA, but why is that? It’s simple! Our cost of living is a lot cheaper than it is in California. This includes, food, gas, property taxes and a lack of a state income tax also helps you! Just think about not having to pay 14.4% in state income taxes every year. That’s a huge savings right there not including your property taxes. If you want to buy a resale home on the MLS in Summerlin for example that property tax is calculated between .64% and .75.% of the sales price. If you sales price is $500,00.00 at a .75% tax rate you are looking at a yearly property tax around $3,750.00. This is of course on the high end. New home construction is calculated around 1% to 1.10% of the sales price.

As a Summerlin Realtor and Las Vegas Realtor I am going to tell you OF COURSE IT’S A GREAT IDEA, but why is that? It’s simple! Our cost of living is a lot cheaper than it is in California. This includes, food, gas, property taxes and a lack of a state income tax also helps you! Just think about not having to pay 14.4% in state income taxes every year. That’s a huge savings right there not including your property taxes. If you want to buy a resale home on the MLS in Summerlin for example that property tax is calculated between .64% and .75.% of the sales price. If you sales price is $500,00.00 at a .75% tax rate you are looking at a yearly property tax around $3,750.00. This is of course on the high end. New home construction is calculated around 1% to 1.10% of the sales price.

If you continue to pay taxes in California, expect it to rise. Here is a great video to watch about California Taxes and the rates that you are paying:

Watch this video about California taxes

What is it Like to Live in Summerlin and Las Vegas?

I left Los Angeles in 2003. 21 years later, I am running my own successful real estate business. I have less traffic to deal, less smog, more freedoms in Nevada than I had in California. The Las Vegas Valley continues to see growth in new industries such as tech companies, construction, professional sports, medical research and in the next few years the motion picture industry will also have a strong presense here. All of this opportunity makes the Las Vegas Valley a great place to live.

I left Los Angeles in 2003. 21 years later, I am running my own successful real estate business. I have less traffic to deal, less smog, more freedoms in Nevada than I had in California. The Las Vegas Valley continues to see growth in new industries such as tech companies, construction, professional sports, medical research and in the next few years the motion picture industry will also have a strong presense here. All of this opportunity makes the Las Vegas Valley a great place to live.

We have very seasonal weather too! If you like the outdoors, you can ski 30 minutes to the north of Las Vegas. If you love to mountain bike or hiking, you can do both! Like to 4X4? Plenty of places to explore right outside of Las Vegas! Love professional sports? We have the NFL, NHL, WNBA and MLB is coming in 2028! Love to eat out like I do? This is a foodies dream come true! I can go on and on about Las Vegas and Summerlin but it’s up to you to make that call to me so that we can chat about Las Vegas real estate and Summerlin real estate! As your Summerlin Realtor, I can tell you more about this amazing community!

In Closing…

Summerlin real estate and Las Vegas real estate remains affordable for people that are moving from California to Nevada for several reasons. First off, your housing market is more expensive than ours. As I stated above, your property taxes are more expensive too. As your Summerlin Realtor, I can explain to you all of the reasons you should leave California but after that it’s up to you to change your life and your life style.

Summerlin real estate and Las Vegas real estate remains affordable for people that are moving from California to Nevada for several reasons. First off, your housing market is more expensive than ours. As I stated above, your property taxes are more expensive too. As your Summerlin Realtor, I can explain to you all of the reasons you should leave California but after that it’s up to you to change your life and your life style.

I can help you, let’s chat some time. Call me directly at: 702-768-2552. Be sure to check out my web site too: www.lvrealty4sale.com. You can also check out over 400+ drone flight videos of Summerlin and the Las Vegas valley here: www.youtube.com/summerlinrealtor

- I am not a CPA nor am I giving you tax advice. I am just pointing out current facts regarding taxation in California and Nevada. Please seek professional assistance for any tax questions you may have. For real estate questions, please contact me anytime.