Short Sales Returning to Las Vegas?

November 1, 2023

Why Relocate To Summerlin, Nevada?

November 25, 2023Summerlin Real Estate News And National Economic News in Brief:

The following information is used to show how local Summerlin Real Estate news is being affected by the current national economy and how inflation is a key factor here locally and nationally. As your Summerlin Realtor, I want to make sure that my clients and the people that follow me on the web have current information. If you have any questions about Summerlin Las Vegas real estate, please contact me directly at: 702-768-2552. You can also check out my You Tube Channel here: www.youtube.com/summerlinrealtor

If you are wanting to search homes in Summerlin, Las Vegas or Henderson, click here: https://lvrealty4sale.com/advanced-home-search/

Lower than expected inflation figures for October convinced the market that the Fed is done hiking rates and may start cutting rates as early as the first half of 2024. Average 30-year mortgage rates have dropped significantly in recent weeks, from over 8% to below 7.4%.

Inflation Elation — Part I. The “headline” CPI (Consumer Price Index = inflation for you and me) was FLAT month-over-month in October, as falling energy prices offset higher shelter and food costs. On a year-over-year basis, “headline” CPI dropped to +3.2% (from +3.7% in September) and “core” CPI eased to +4.0% (from +4.1% in September). [Bureau of Labor Statistics]

Party time for bonds. The lower-than-expected CPI figures ignited a major rally in bonds, with the yield on the 10-year US treasury plunging below 4.5%, and the average rate on a 30-year mortgage dropping to 7.36%. As a reminder, average mortgage rates were at 8.03% less than a month ago. [Mortgage News Daily]

From hikes to cuts? Just before the CPI figures came out, the market was pricing in a ~30% chance of another rate HIKE in January. After the CPI figures came out, that swung to a small chance of a CUT. Looking further out, the market is now pricing in 4 rate CUTS before end-2024. Clearly the market doesn’t believe the Fed’s “higher for longer” rhetoric. [CME]

Inflation Elation — Part II. A day after the CPI came out, the BLS released the PPI (Producer Price Index = inflation for companies) and “headline” PPI dropped 0.5% month-over-month, bringing the year-over-year figure to just +1.3%. [Bureau of Labor Statistics]

Still shopping, not yet dropping. Retail sales fell 0.1% month-over-month in October, mainly as a result of falling gas prices. Remember: the retail sales figure doesn’t adjust for inflation. The result was actually a bit stronger than Wall Street economists were looking for (-0.2% to -0.3%). Retail sales excluding autos and gas rose 0.1% MoM. [Census Bureau]

More than just a seasonal slowdown. The MBS Highway Housing Survey for November showed a further slowdown in buyer activity as 30-year mortgage rates climbed briefly above 8%. In October, and the prevalence of price reductions increased. Of note: a big drop in activity levels in the Northeast, and a potential bottoming in the Northwest, Midwest and Southwest.

Homebuyer pessimism. A record 85% of consumers said it was a “Bad Time to Buy” in Fannie Mae’s monthly Home Purchase Sentiment survey, and 78% said the US economy was “On the Wrong Track.” I would, however, point out that 65% of consumers thought it was a “Bad Time to Buy” in June 2021 and home prices have risen 20% since then.

Zillow’s October Housing Report. Home prices are falling month-over-month in most of the US as “mortgage rates at 23-year highs and the usual seasonal housing cooldown take their toll.” But home values are still up year-over-year in 34 of the 50 largest markets. Prices in Austin and New Orleans are down the most (both -9% YoY,) while Hartford CT (+11% YoY) and Milwaukee WI (+9% YoY) are up the most.

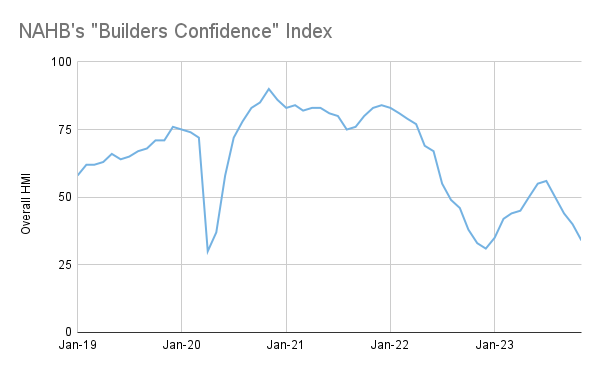

Builders are more bearish. The NAHB’s Housing Market Index (a.k.a. Builder’s Confidence Index) dropped to 34 in November (from 40 in October). Anything below 50 implies a contractionary environment. Why the long faces? Higher mortgage rates (for would-be buyers) and higher borrowing rates (for builders to finance projects.) It’s important to note, however, that the index was at 33 last November AND this survey won’t have captured the recent, sharp fall in rates.

If you are thinking about relocating to Summerlin, call me today. I look forward to becoming your Summerlin Realtor. As always, I am more than happy to discuss Summerlin Real Estate with you and what your options are. Summerlin Las Vegas real estate changes all the time. Make sure you pick a Summerlin Realtor that stays current on all trends that can affect your decission to purchase a new home.